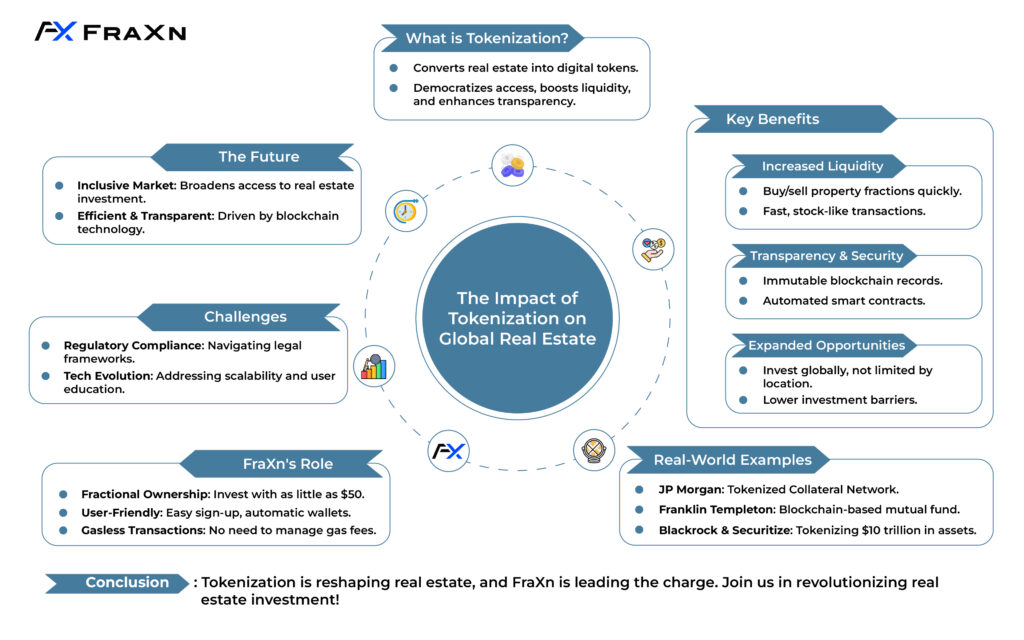

In recent years, the global real estate market has experienced a significant transformation with the advent of blockchain technology and the rise of tokenization. By converting physical assets into digital tokens, tokenization is set to revolutionize how we invest in and interact with real estate.

This innovative approach promises increased liquidity, enhanced transparency, and expanded investment opportunities. Let’s explore the broader effects of tokenizing real estate assets and how it is reshaping the global real estate landscape.

One of the most substantial impacts of tokenization on the global real estate market is the potential for increased liquidity. Traditional real estate investments often require significant capital and involve lengthy, cumbersome processes, making it difficult for investors to quickly buy or sell properties. This lack of liquidity has long been a barrier for many potential investors.

Tokenization changes this dynamic by allowing properties to be divided into smaller, tradable digital tokens. Investors can buy and sell these tokens on blockchain-based platforms, similar to how stocks are traded on exchanges.

This fractional ownership model not only makes it easier to enter and exit investments but also attracts a broader range of investors, from institutional players to individual retail investors. As a result, the real estate market becomes more dynamic, with higher transaction volumes and quicker turnaround times.

Transparency has always been a critical concern in real estate transactions. Traditional real estate deals often involve multiple intermediaries, creating layers of complexity and potential for fraud or misrepresentation. Tokenization, powered by blockchain technology, addresses these issues by providing an immutable, transparent ledger of all transactions.

Every transaction and ownership change is recorded on the blockchain, ensuring that all parties have access to accurate and up-to-date information. This level of transparency not only builds trust among investors but also reduces the risk of fraud and disputes. Additionally, blockchain’s inherent security features, such as cryptographic encryption, ensure that all data is secure and tamper-proof.

Tokenization opens up a world of new investment opportunities in the real estate sector. By lowering the barriers to entry, tokenization allows more people to invest in real estate, including those who may not have had the financial means to do so previously. Investors can now diversify their portfolios by purchasing fractions of multiple properties, rather than being limited to a single, large investment.

This democratization of real estate investment means that more people can benefit from the potential returns of this traditionally lucrative asset class.

Furthermore, tokenization enables cross-border investments, allowing investors to participate in real estate markets around the world. This global reach can lead to more diversified portfolios and reduced risk, as investors are not solely dependent on the performance of their local real estate market.

Several major financial institutions and companies have already recognized the potential of tokenization and are leading the charge in this new frontier. For instance, JP Morgan launched the Tokenized Collateral Network (TCN) in 2023, leveraging blockchain technology to transform real-world assets into digital tokens.

Similarly, Franklin Templeton introduced the Franklin OnChain U.S. Government Money Fund, providing investors with the first U.S.-registered mutual fund on a public blockchain.

The European Investment Bank (EIB) also made significant strides by issuing its first $103 million digital bond in 2021, registering and settling bonds on a blockchain. These moves by prominent financial institutions highlight the growing acceptance and adoption of tokenization in the real estate market.

Moreover, Blackrock’s partnership with Securitize aims to tokenize over $10 trillion of Blackrock’s assets, marking a monumental shift in how real-world assets are traded and managed.

This partnership underscores the potential of tokenization to reshape traditional investment strategies and unlock new opportunities for investors worldwide.

FraXn is at the forefront of this revolution, leveraging blockchain technology to democratize real estate investment.

By offering fractional ownership of high-value properties, FraXn enables investors to participate in the real estate market with smaller amounts of capital. This approach not only makes real estate investment more accessible but also enhances liquidity and transparency.

FraXn’s platform simplifies the investment process, allowing users to sign in using their email addresses or phone numbers and automatically creating a digital wallet for them.

Additionally, FraXn offers gasless transactions, eliminating the need for users to manage gas fees and making the investment process more affordable and user-friendly.

Smart contracts play a pivotal role in the tokenization of real estate. These self-executing contracts, with the terms of the agreement directly written into code, automate many aspects of real estate transactions. For instance, smart contracts can handle rental income distribution, property management tasks, and the transfer of ownership.

By automating these processes, smart contracts reduce the need for intermediaries, further lowering transaction costs and increasing efficiency. This automation also ensures that all parties adhere to the agreed-upon terms, reducing the potential for disputes and misunderstandings.

While the benefits of tokenization are clear, there are also challenges that need to be addressed. Regulatory compliance is a significant concern, as the legal frameworks governing real estate and securities vary widely across different jurisdictions.

Ensuring that tokenized real estate transactions comply with these regulations is crucial for the long-term success and adoption of this technology.

Additionally, the technology itself is still evolving, and issues related to scalability, interoperability, and user education need to be tackled.

As the market matures, it will be essential for platforms offering tokenized real estate investments to work closely with regulators, technology providers, and investors to create a secure and robust ecosystem.

The tokenization of real estate assets has the potential to revolutionize the global real estate market by increasing liquidity, enhancing transparency, and expanding investment opportunities.

By leveraging blockchain technology, tokenization can democratize access to real estate investments, making it possible for a broader range of investors to participate in this valuable asset class.

As the technology and regulatory frameworks continue to evolve, the impact of tokenization on the real estate market is likely to grow, paving the way for a more efficient, transparent, and inclusive investment landscape.

With FraXn leading the charge, the future of real estate investment looks promising, offering new opportunities and benefits to investors around the world.

Join us at FraXn as we continue to innovate and transform the real estate market through the power of blockchain technology.